Have you insured your family for whole life with LIC?

It’s Ok, Now, you should know about LIC’s New Bima Diamond Plan. It is really diamond plan for covering the risk of the life.

LIC New Bima Diamond Plan introduced for the whole life of the policyholder by LIC of India. It is non-linked insurance plan that provides a great mixture of safety and financial protection. In this plan, LIC provides not only maturity but also cover the life risk after maturity period. This scheme also takes care of financial requirement by way of its policy loan facility.

New Jeevan Anand is a perfect blend of endowment plan, money back plan, and a whole life plan. This combination provides financial protection against death throughout the lifetime of the policy holder with lump-sum payment at the end of selected policy term in case of his or her survival.

Key Features:

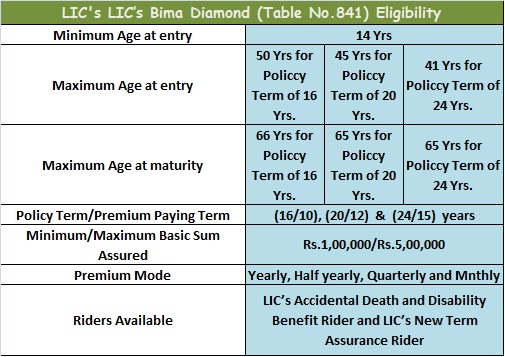

- Premium Payment Mode: It may be Monthly [ECS], Quarterly, Half-yearly, and Yearly.

- Minimum Sum Assured: The minimum amount: 1,00,000 and maximum amount: 5,00,000.

- Minimum Entry Age: Policy holder should be complete the age of 14 year and maximum age 41/45/50 year in this policy.

- Policy Term(PPT): Term is 16(10), 20(12), and 24(15).

For Example: if your policy term (24 (15)). It means premium paying term would be for 15 years. And, maturity will pay after 24 years by LIC. You have to pay only for 15 years.

- Rider Benefit: Rider benefits (Accidental death and disability) should be available up to age 65/66 years.

Benefits of Bima Diamond:

Loyalty: Loyalty addition

Death Benefits: Lic of India provides benefits on natural death

Death=100% of S.A + Loyalty Addition

Double Accidental Benefits: Policyholder can claim on LIC of India for receiving DAB.

DAB= 100% of S.A + Loyalty Addition

Maturity Benefits: On survival till plan term ends.

Maturity= S.A + Loyalty

Tax benefits: Policy holder can claim for saving the tax under section 80C, and under section of 10(D) of income tax act.

Pension: Policy holder can transform his/her policy into pension plan so that he/she could earn regular money after retirement.

Auto Cover: It is the period during which full risk cover is available for the life assured even if the premium is not paid during this period.

Required Documents:

The necessary documents required to be insured under the New Jeevan Anand Plan. Below are some basic documents required to getting insured by the LIC plan. All documents should be self-attested.

- Correctly filled application form/ Proposal form

- Address proof like Voter ID Card, Aadhar card etc.

- Age proof such as 10th Marksheet, Pancard etc.

- Other KYC Documents.

- Medical History.

- Medical diagnosis report as required.

LIC Bima Diamond Illustration:

Name: Mr. Rakesh

Sum Assured: Rs. 5,00,000

Age: 26 year

Term: 24(15) year

Paying premium term: 15 years

Risk cover: Extend the free risk cover for 12 years of half amount of Sum assured after maturity.

Policy holder have to pay regular premium either monthly, or yearly etc. whatever payment mode at the end of the maturity.

Premium: Yearly=30297, Half-yearly=15307, Quarterly=7733, Monthly=2578.

Double Accidental Benefit: Rs.5,00,000 + Loyalty

As told above, It is also a money back policy. So policy holder will get 12% of every 4th year till maturity.

4th year: Rs. 60,000

8th year: Rs. 60,000

12th year: Rs. 60,000

16th year: Rs. 60,000

20th year: Rs. 60,000

24th year: Rs.6,00,000 (40% of Sum Assured)

After maturity, It also extends free risk cover for 12 years.

After Maturity: Rs. 2,50,000 free risk cover for 12 years again.

You can surrender Rs.2,50,000 except maturity whenever you need money or LIC will pay to your nominee after your death.

Bima Diamond is really diamond plan. Happiness forever!

Conclusion:

Being an LIC Advisor, I would suggest you always choose the plan according to your needs and budget. But, you must be done at least 1 policy. It ensures you and your family. It is a great investment for future. Thanks for reading my blog and all the best!!